EV Fleet Leasing:

Scale Your Fleet With Lower Upfront & Ownership Costs

Are you considering leasing a fleet of electric vehicles? With their lower overall costs and significant environmental benefits, EV fleets are transforming the way fleet managers and owners operate. And with Spring Free EV, fleet electrification has never been easier.

Why Choose Spring Free EV for Your Fleet Leasing?

Spring Free EV is built to meet the needs of high-mileage commercial fleets.

-

No Down Payment

Leasing an electric vehicle—much less an entire fleet—often requires a substantial upfront payment. Spring Free EV eliminates this barrier by offering a no down payment option, making electric commercial fleets that much more accessible.

-

No Mileage Cap

Spring Free EV is built for high-mileage fleets and provides businesses with the freedom to drive as much as they need without worrying about extra charges.

-

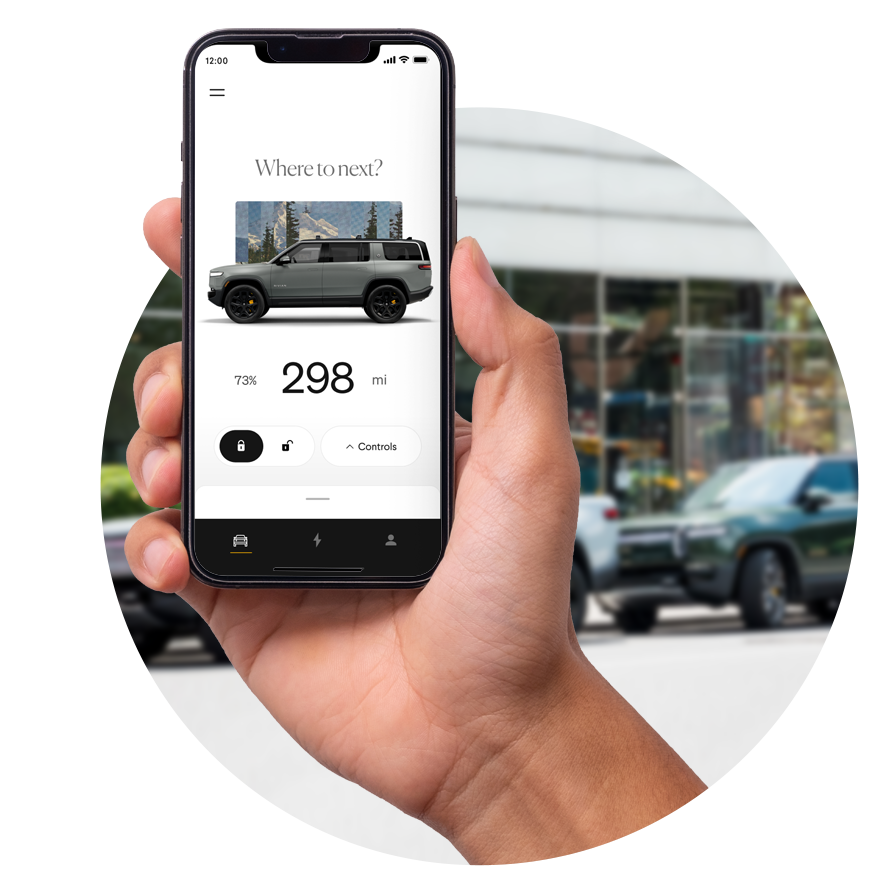

Access to the Latest EV Models

Spring Free EV offers a selection of high-quality battery electric vehicles, including top-rated models like Teslas and Chevy Bolts. Businesses can now drive some of the best BEVs on the market without a large upfront investment or long-term commitment.

-

Flexibility and Convenience

Spring Free EV offers a flexible subscription model that allows businesses to switch between different EV models or change their subscription at any time. Quickly and conveniently adapt your lease to fit market changes and business needs.

Our EV Fleet Leasing Models

Spring Free EV offers business owners access to the latest EV models on the market. With EV fleet management, companies will look good and save big. With lower maintenance costs, lower fuel costs, and charging infrastructure improving every day, EV fleet solutions have never been better.

Tesla

Model 3

The Tesla Model 3 is a popular EV known for its impressive performance, cutting-edge technology, and sleek design. Within four seconds, the Model 3 can smoothly and quietly accelerate to 60 miles per hour. Model 3 have 330 mile ranges and are available in AWD or RWD. With its minimal and modern design, state-of-the-art technology, and exceptional safety features, the Model 3 is an excellent choice when looking to optimize fleet operations.

Tesla

Model Y

The Model Y is a compact electric SUV that has become popular for its versatility, performance, and advanced technology. It takes the Model Y a mere 4.8 seconds to accelerate to 60 miles per hour. With a full battery, the Model Y can travel 300 miles, and just fifteen minutes of charge time at a Tesla SuperCharge station reboots its range to 175 miles. With a sleek design, spacious cabin, and a generous amount of cargo space, the Model Y is a perfect SUV for fleets needing slightly larger vehicles.

Chevy

Bolt

The Chevrolet Bolt is a compact electric vehicle known for its affordability, functionality, and efficient electrical performance. The Chevy Bolt has a range of 260 miles and can accelerate up to 60 mph in 6.5 seconds. Looking for a slightly larger vehicle with a low total cost of ownership? Look no further than the Chevrolet Bolt.

Flexible and

Affordable Pricing

Spring Free EV is committed to providing flexible and affordable pricing that makes operating EV fleets accessible for businesses of all sizes.

To lease a Tesla, businesses pay a base rate that comes with 1,800 miles/month built in. To build beyond the base rate, leases have a pay-per-mile subscription model with no mileage caps. Cruise the town and get business done without worry of additional fees.

Similarly, the base rate for the Chevrolet Bolt includes 2,000 miles/month built in, with a pay-per-mile subscription model beyond that.

With short, flexible lease terms, businesses are able to return, renew, and purchase in as little a time as one year.

Spring Free EV:

A Different Approach to Fleet Leasing

Spring Free EV offers electric vehicle leasing solutions with a unique focus on the needs of business, especially those that require high mileage driving.

Focus on Commercial Use

Traditional leasing models are designed for personal use, with contracts stipulating limits on mileage and wear and tear that make them less than ideal for commercial use. Spring Free EV, however, structures its leasing terms to be more accommodating for businesses that need to use vehicles extensively.

High Mileage Driving

Traditional leases often come with mileage limits, and exceeding these can result in hefty additional costs. Spring Free EV offers a flat rate with no mileage caps, making it more suitable for delivery services, ride-sharing, and other high-mileage businesses.

Business Health Check

Traditional car leasing usually involves a credit check to assess the individual’s creditworthiness. Spring Free EV, however, conducts a business health check to assess the financial stability and profitability of a business as a whole. This is perfect for startups or those with unconventional financial profiles that might not pass a traditional credit check but are otherwise financially sound. Spring Free EV takes a holistic approach when assessing businesses and their finances.

Join Our Mission to Reduce Climate Change

There has never been a better time to electrify your fleet vehicles: Public charging stations are becoming more and more common and the call for sustainability that much stronger. Join the mission to release zero emissions and make a positive impact on our environment. Get started with Spring Free EV and transform your fleet into a more sustainable, efficient, and cost-effective operation.

Contact us today to explore our flexible leasing options tailored to your business needs. Let’s drive change together and pave the way for a cleaner, greener future!

EV Fleet Leasing Guide

What is EV fleet leasing?

EV fleet leasing is the practice of renting two or more electric vehicles for commercial purposes. By leasing company vehicles, businesses, government agencies, and other organizations reap the benefits of electric vehicles without fully committing to purchasing them. This allows organizations of all types to save money, remain flexible, and adapt to ever-changing business needs.

What are the top factors to consider when selecting a fleet leasing option?

Not all fleet leasing options are created equal. That’s why choosing the right lessor and partner makes such a difference. Here are some top factors to consider when selecting a fleet lease.

- Vehicle Type and Specifications:

- The vehicles offered by the lessor are one of the first factors to consider. Consider the types of vehicles that best suit your operational needs, whether sedans, trucks, vans, or electric vehicles.

- Beyond vehicle type, consider the specifications and features your fleet will need. Do your cars need significant cargo space or be incredibly fuel efficient? What safety features and technology would you ideally like to have in each vehicle?

- Leasing Terms and Conditions:

- The next most significant piece to consider is the lease’s fine print. Comb through the leasing terms, including the duration of the lease, mileage restrictions, and any penalties for exceeding the allotted mileage. Some lease terms (like Spring Free EV’s) are designed for high-mileage usage and therefore have no mileage caps.

- Understand the terms of the lease agreement, including responsibilities for maintenance, repairs, and insurance. Some of the best leases include maintenance and repair built into them.

- Costs and Budgeting:

- Of course, consider your budget. You need a lease that will help you keep your costs low and your profits high. Analyze the overall costs associated with the leasing option, including monthly lease payments, insurance, maintenance, and potential fees.

- Leasing is often much simpler and more cost effective than purchasing the vehicle outright. But make sure to check. Compare the total cost of ownership for leasing versus purchasing to determine the best option for your organization.

- Fuel Efficiency and Environmental Impact:

- More and more consumers and businesses are becoming eco-conscious and looking for ways to reduce their carbon footprint. Choosing electric vehicles for your company cars is one of the best ways to make your fleet sustainable. And with Spring Free EV, electrifying your fleet has never been easier.

- Don’t forget to look into government incentives and tax breaks for choosing eco-friendly options. You might be surprised by how well an EV can save money, benefit the environment, and meet your business needs.

- Maintenance and Support Services:

- Make sure the lease spells out a plan for maintenance and support services. Determine whether routine maintenance, repairs, and roadside assistance are included in the leasing agreement.

- Before signing a lease, make sure you fully understand the process for addressing maintenance issues and how quickly repairs can be made.

- Flexibility and Upgradability:

- Business needs change. And whether that means you need to add five more cars, upgrade to the latest models, or scale down a bit, you want the freedom to do so. Assess the flexibility of the leasing arrangement and make sure it works for you.

- Insurance Coverage:

- Insurance is a huge piece of the puzzle when working in fleet management. Make sure you fully understand the insurance coverage provided by the leasing company and whether it meets your organization’s requirements.

- Some lessors will not provide insurance. If that is the case, make sure you know the best options for fleet insurance and how to get it.

- Resale Value and Depreciation:

- With all leases, there is an end to the deal. Make sure you understand how the lessor will handle resale value and depreciation, especially if you are interested in purchasing the vehicle at the end of the lease.

- Make sure to think ahead. Consider how depreciation factors into the overall cost of the leasing option and whether it aligns with your organization’s financial goals.

- Reputation of Leasing Provider:

- One of the most significant factors is who you will choose as your leasing provider. Research and consider the reputation and reliability of the leasing provider. Your lessor will hopefully become a trusted business partner. So, make sure to look for customer reviews, testimonials, and references to make sure you choose the right fit.

- Regulatory Compliance:

- You want to be above board in all your business dealings. Ensure that the leasing arrangement complies with relevant regulations regarding vehicle safety standards and financial regulations.

EV Fleet Leasing vs Owning: What’s the difference?

When expanding your EV fleet, it can be hard to know whether you should lease or buy vehicles. The option you choose will significantly impact your business’s operational efficiency, financial health, and environmental footprint.

Let’s look at both options to understand their distinct advantages and considerations:

Leasing an EV Fleet

- Lower Upfront Costs: Leasing requires less capital upfront compared to purchasing vehicles outright. The lower upfront costs make EVs much more accessible for businesses.

- Flexibility: Leasing contracts offer flexibility in terms of fleet size and vehicle type. Businesses can adjust their fleet according to changing needs without being committed to specific vehicles.

- Maintenance and Upgrades: Many leasing agreements include maintenance and servicing, which reduces the operational burden on businesses. What’s more, at the end of the lease term, businesses can upgrade to newer models, ensuring the fleet remains up-to-date and efficient.

- Financial Predictability: Leasing provides predictable monthly expenses, which helps businesses budget and plan for the future. There are also potential tax benefits, as lease payments can often be deducted as a business expense.

- No Depreciation Concerns: Leased vehicles are returned at the end of the lease term, so businesses don’t need to worry about the depreciation and resale value of the EVs.

Owning an EV Fleet

- Long-Term Savings : Although the initial purchase cost is higher, owning an EV fleet can be more economical in the long run. Without lease payments, the total cost of ownership is often lower over the vehicles’ life.

- Depreciation Benefits: Businesses can benefit from depreciation deductions on their taxes, which can offset some of the costs of purchasing the vehicles.

- Full Control and Customization: Owning the vehicles allows for customization to meet specific business needs without restrictions often imposed by leasing agreements.

- No Mileage Restrictions: Leased vehicles typically come with mileage limits (except with Spring Free EV), whereas owning vehicles eliminates concerns over exceeding such limits and incurring additional fees.

- Asset Ownership: The vehicles are business assets and can be leveraged as collateral or sold outright, providing financial flexibility.

How to Decide between Leasing and Owning

To decide whether you should buy or lease an EV fleet, take these factors into account:

- Your finances and budget: Do you have the cash to buy vehicles outright? Or does it work better for your budget to pay monthly leasing fees?

- Your business model: Do you need the flexibility inherent in leasing? Or would you prefer to customize vehicles you actually own?

- Operational Needs: How often do you need to upgrade vehicles? How important is it to you to have the latest models on the market?

- Environmental Goals: Is sustainability a high priority for your business? Does having an electric fleet matter more to you than owning the vehicles?

Leasing offers flexibility, lower upfront costs, and ease of upgrading, making it suitable for businesses looking for minimal commitment and maximum adaptability. Owning, on the other hand, offers long-term cost savings, tax benefits, and complete control over your fleet, appealing to businesses prepared to make a larger initial investment for greater autonomy and efficiency over time.

There’s no right or wrong answer. It’s a matter of assessing your finances and business goals to see which option works best for you.

What’s the difference between a closed-end lease and an open-end lease?

Closed-end and open-end leases are the two primary types of lease agreements. Each has distinct terms and conditions that cater to different needs and preferences. Understanding the differences between these leasing options helps businesses decide which one will best fit their needs.

Closed-End Lease

A closed-end lease, often referred to as a “walk-away” lease, is the most common type of lease for consumer vehicles. Here are its key characteristics:

- Fixed Terms: The lease duration, mileage limit, and monthly payments are predetermined. At the end of the lease term, the lessee can simply return the vehicle and walk away, assuming there are no damages or excess mileage fees.

- No Residual Risk: The lessee is not responsible for the vehicle’s residual value (the vehicle’s worth at the end of the lease). If the actual value is lower than the estimated residual value, the lessor bears the loss.

- Mileage Limits: There are usually strict mileage limits. Exceeding these limits results in additional charges.

- Condition Requirements: Upon return, the vehicle must meet certain condition standards. Excessive wear and tear often results in additional charges.

- End-of-Lease Options: Lessees can return the vehicle, purchase it for the residual value, or lease a new vehicle.

Open-End Lease

An open-end lease, also known as a finance lease, is more common for businesses. Its features include:

- Flexible Terms: Open-end lease terms are more flexible, with less emphasis on mileage limits. This type is often used for commercial vehicles where usage varies significantly.

- Residual Risk: The lessee assumes the risk for the residual value of the vehicle. If the vehicle is worth less than the estimated residual value at the end of the lease, the lessee must cover the difference.

- Customizable Mileage: Mileage limits are either very generous or non-existent, making this lease type suitable for high-mileage users.

- Tailored Payments: Payments can be tailored to the lessee’s needs, potentially leading to lower initial payments compared to a closed-end lease.

- End-of-Lease Settlement: At the end of the lease, the vehicle is sold, and the lessee is responsible for any difference between the sale price and the residual value forecasted at the lease’s inception.

How to Choose between an Open-End Lease and a Closed-End Lease

Choosing between a closed-end and open-end lease depends on several factors:

- how much your business drives

- how well you can predict the vehicles’ use over the lease term

- your willingness to assume residual value risk

Closed-end leases offer more predictability and less risk for the lessee, making them ideal for individuals and businesses that prefer fixed costs and no surprises at the end of the lease.

Open-end leases offer more flexibility and are cost-effective for businesses with unpredictable vehicle usage patterns. But open-end leases come with the risk of additional costs if the vehicle’s residual value is less than expected.

What is the best length of a lease for a commercial EV fleet?

The optimal lease term for businesses leasing EV fleets varies based on several factors:

- your business’s operational needs

- financial considerations

- the pace of advancements in EV technology

Generally, lease terms can range from short-term leases of 12-24 months to longer-term leases up to 36-60 months.

Let’s look at some key considerations for determining the ideal lease length for your fleet:

Business Needs and Usage Patterns

- Operational Flexibility: Shorter leases provide more flexibility to adapt fleet size and composition as business needs change. If your business is growing or has fluctuating vehicle needs, shorter leases are a good idea.

- Vehicle Wear and Tear: Consider how intensely you expect to use your vehicles. Businesses with high mileage requirements might prefer shorter leases to avoid excess mileage charges and to mitigate the risk of wear and tear.

Financial Considerations

- Budget and Cash Flow: Longer leases typically offer lower monthly payments compared to shorter leases. This can help with budgeting and cash flow management. However, make sure to consider the total cost over the entire lease term.

- Tax and Accounting Implications: Lease payments can often be deducted from taxable income. Make sure, then, to evaluate the impact of the lease term on your financial statements and tax obligations.

Technological Advancement

- Rapid Technology Evolution: The EV market is characterized by rapid advancements in technology. Every day, there are improvements to battery life, vehicle range, and charging infrastructure. Shorter leases allow businesses to upgrade to newer models more frequently, taking advantage of these advancements.

- Depreciation and Residual Value: EVs experience different depreciation rates compared to conventional vehicles, influenced by technological advancements and changes in government incentives. Shorter lease terms mitigate uncertainties related to residual value.

Environmental Goals

- Sustainability Objectives: Leasing newer EVs more frequently can support a business’s sustainability goals by utilizing the latest in energy-efficient technology and reducing their carbon footprint.

Market and Incentives

- Government Incentives: Availability of government incentives for leasing EVs can also influence the optimal lease term. Some incentives might be more advantageous with certain lease lengths.

- Market Conditions: The leasing market’s conditions, including interest rates and availability of specific EV models, can impact the decision on lease term length.

There is no one-size-fits-all answer to the ideal lease term for an EV fleet. Businesses should consider their specific operational needs, financial constraints, and strategic goals. Engaging with lease advisors, analyzing total cost of ownership (TCO), and staying informed about the EV market and technology trends are critical steps in making an informed decision. Shorter leases offer flexibility and access to the latest technology, while longer leases provide financial predictability and lower monthly costs.

What essential EV fleet terms should businesses have in their lease agreements?

Carefully crafted lease agreements protect businesses from unforeseen expenses and legal issues while ensuring flexibility and efficiency. Here are key lease terms that you should consider:

Lease Duration

Term of Lease: Clearly define the start and end dates of the lease. Think through your optimal lease length based on business needs, technological advancements, and financial implications.

Monthly Payments

Payment Amount: Specify the amount of monthly lease payments and any factors that could affect this amount.

Payment Schedule: Outline when payments are due and any grace periods or penalties for late payments.

Mileage Limits and Charges

Mileage Allowance: Clearly state the annual mileage limit and the cost per mile for exceeding this limit. Businesses with high mileage needs should negotiate adequate limits to avoid excessive overage charges.

Maintenance and Repairs

Responsibility for Maintenance: Define who is responsible for routine maintenance and repairs. Some leases include maintenance packages, which can be beneficial for businesses to manage costs.

Wear and Tear Policies: Understand what is considered normal wear and tear versus chargeable damage.

Insurance and Liability

Insurance Requirements: Specify the types and amounts of insurance coverage required, including liability, comprehensive, and collision insurance.

Liability in Case of Accident: Clarify the lessee’s and lessor’s liabilities in case of an accident involving the leased vehicle.

Early Termination Conditions and Penalties

Termination Clauses: Outline the conditions under which the lease can be terminated early, including any penalties or costs associated with early termination. It is crucial for businesses to understand their financial obligations.

Option to Purchase

Purchase Option: If relevant, include terms under which the lessee can purchase the vehicle at the end of the lease term, including how the purchase price will be determined.

Modifications and Customizations

Vehicle Modifications: State any restrictions on vehicle modifications or customizations, and whether modifications need to be removed or compensated for at the end of the lease.

Return Conditions

Vehicle Return Conditions: Detail the condition in which the vehicle must be returned, including mileage, wear and tear, and any required documentation.

Technology and Upgrades

Software Updates: Ensure there are provisions for necessary software updates for EVs to maintain performance and safety standards.

Charging Infrastructure

Charging Solutions: If applicable, include any agreements on the provision or installation of EV charging infrastructure by the lessor.

Government Incentives and Tax Benefits

Incentive Capture: Detail how any government incentives, rebates, or tax benefits related to EVs are handled between the lessor and lessee.

Ensuring these terms are clearly addressed in the lease agreement helps businesses effectively manage their EV fleets, minimize unexpected costs, and align the lease with their broader goals. It’s also smart to consult with legal and financial professionals when negotiating lease agreements to ensure all aspects are covered comprehensively.

What are the top EV fleet leasing tips?

Now that we’ve looked at all the factors to consider when looking at leases let’s dive into our tried-and-true leasing tips for electric vehicles.

- Understand Charging Infrastructure:

One of the big differences in leasing EV’s is that you need the right equipment. And while the infrastructure for charging electric vehicles is growing rapidly, it’s still critical to ensure your drivers have access to charging stations when and where they need them. Talk with your lease providers about the vehicles’ charging needs and what types of chargers (level 1, level 2, DC fast chargers, Tesla superchargers) are available in your area. - Range Consideration:

Similarly, understanding the driving range of each vehicle, especially if used for high-mileage commercial needs, is critical. Learning the capabilities of each vehicle and how to plan routes to minimize downtime properly is essential to establishing a successful fleet of electric vehicles. - Training for Drivers:

It’s no secret that EV’s require a bit of a learning curve. Whether it’s learning how to charge the battery, monitor range, or utilize better sustainable driving practices, drivers need to be properly trained on using electric vehicles. Regularly invest in workshops, trainings, and seminars to increase driver knowledge and their safety. - Consider the Total Cost of Ownership:

One of the most significant benefits of EVs is their overall cost-savings. When looking at finances, conduct a comprehensive analysis of the total cost of ownership that accounts for the lease payments, charging costs, maintenance savings, and potential incentives. Many companies find that by switching to EV’s, they save 60% on maintenance costs alone. - Plan for Future Technological Advancements:

Rapid advancements in EV technology are taking place every day. Make sure your lease terms account for this and allow you to upgrade to newer models with improved features and longer ranges. Build in time to regularly check in on EV advancements to see if it’s time for an upgrade.

By considering and implementing these tips, you will be able to navigate the unique aspects of leasing electric vehicles for your fleet. Contact Spring Free EV today to see how we can help scale and electrify your fleet with ease.

- What is EV fleet leasing?

- What are the top factors to consider when selecting a fleet leasing option?

- 1. Vehicle Type and Specifications

- 2. Leasing Terms and Conditions

- 3. Costs and Budgeting

- 4. Fuel Efficiency and Environmental Impact

- 5. Maintenance and Support Services

- 6. Flexibility and Upgradability

- 7. Insurance Coverage

- 8. Resale Value and Depreciation

- 9. Reputation of Leasing Provider

- 10. Regulatory Compliance

- EV Fleet Leasing vs Owning: What’s the difference?

- Leasing an EV Fleet

- Owning an EV Fleet

- How to Decide between Leasing and Owning

- What’s the difference between a closed-end lease and an open-end lease?

- Closed-End Lease

- Open-End Lease

- How to Choose between an Open-End Lease and a Closed-End Lease

- What is the best length of a lease for a commercial EV fleet?

- Business Needs and Usage Patterns

- Financial Considerations

- Technological Advancement

- Environmental Goals

- Market and Incentives

- What essential EV fleet terms should businesses have in their lease agreements?

- 1. Lease Duration

- 2. Monthly Payments

- 3. Mileage Limits and Charges

- 4. Maintenance and Repairs

- 5. Insurance and Liability

- 6. Early Termination Conditions and Penalties

- 7. Option to Purchase

- 8. Modifications and Customizations

- 9. Return Conditions

- 10. Technology and Upgrades

- 11. Charging Infrastructure

- 12. Government Incentives and Tax Benefits

- What are the top EV fleet leasing tips?

- 1. Understand Charging Infrastructure

- 2. Range Consideration

- 3. Training for Drivers

- 4. Consider the Total Cost of Ownership

- 5. Plan for Future Technological Advancements

EV Fleet Services Across Multiple US States:

Spring Free EV now serves several states across the US, offering businesses in diverse regions the opportunity to upgrade their fleets with our affordable EV leasing programs. Experience the same commitment to efficiency and sustainability, no matter where your business is located.